...

| Multiexcerpt | ||

|---|---|---|

| ||

Your website and credit card payment provider may already have a range of fraud prevention methods in place. If you are using If your website uses eWAY, you can enable this Credit Card Verification as an additional security check for certain credit card orders. The When active, the system will undercharge the card and the buyer must confirm the amount to progress the order. The procedures involved at each stage of verification are automated so minimal handling and attention is needed from your staff. But they can easily track and edit the an order's verification status can easily be tracked and edited in CMS manually , if when required. |

Here is how Credit Card Verification works:

- Orders by guest users and whenever a new credit card is used by a registered User or Customer (which one depends on your settings) are placed on hold if order totals are above the set threshold amount.

- The system charges a randomly-generated amount under the order total (within the limit of what has been set). (The older 'split charge' method is also available. This is a legacy method and no longer supported by Commerce Vision.)

- The buyer receives an order confirmation email, which includes details about how to verify the card.

- The buyer checks the charged amount(s) in their credit card account and returns to your site to enter it in the verification page.

- If successful, the system will release the order for fulfilment as per the usual process, , and if not, cancel it.

Notes

- For Users/Customers, (i) once a credit card has been successfully verified, it can be used for subsequent orders without triggering further security checks; (ii) multiple orders 'pending' against the same credit card will all be released upon successful verification through one of these orders.

- Guest orders over the threshold amount will trigger the verification process even when the credit card has been used before (unless a guest makes multiple purchases in the same browser session).

- CMS users (depending on Role) can track orders flagged for this verification process through the Credit Card Verification page.

- This feature has two modes: 'immediate order integration' ON or OFF. See 'Edit Settings' below for details.

Prerequisites to using Credit Card Verification

| Info | ||

|---|---|---|

| ||

|

Step-by-step guide

...

|

...

|

...

Step-by-step guide

1. Edit settings

Note - you must be a CMS Admin role to configure Credit Card Verification settings.

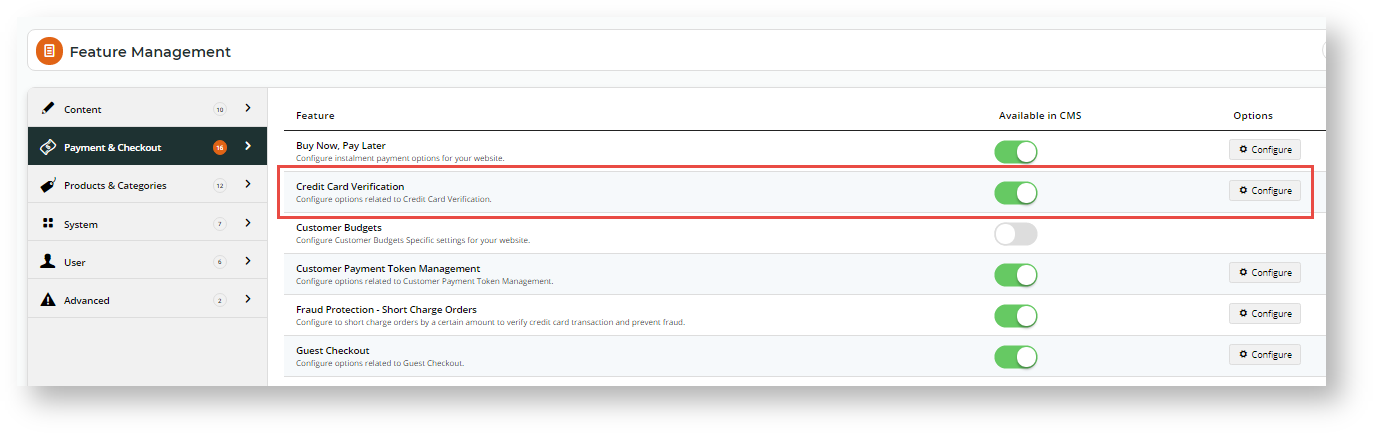

- In CMS, navigate to Settings → Feature Management → Payment & Checkout.

- Toggle on Credit Card Verification and click Configure.

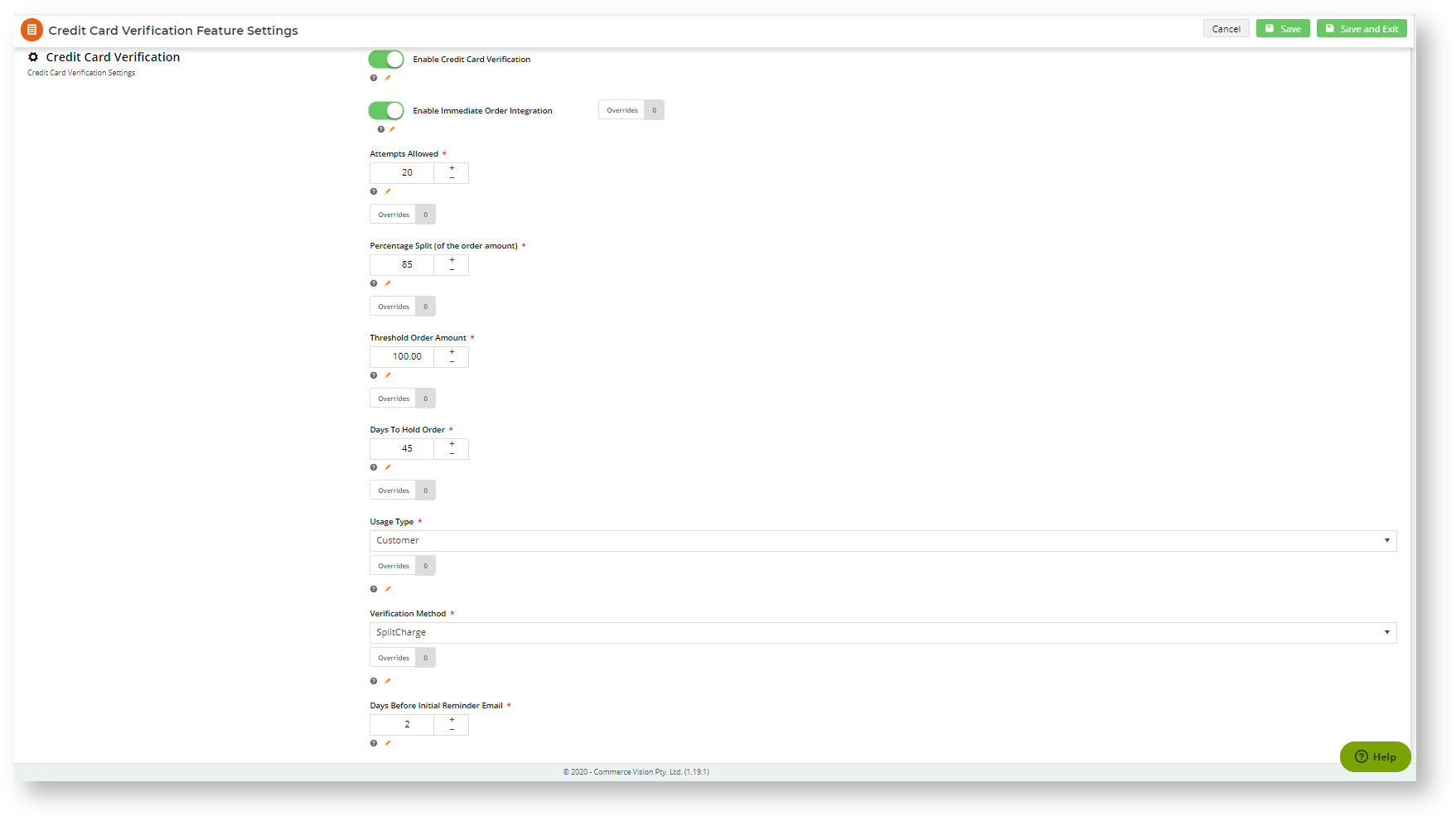

- In the Credit Card Verification page, toggle on Enable Credit Card Verification.

- Accept the default values or change them to match your business requirements.

Option Default Value Description Override Available? Enable Immediate Order Integration OFF OFF: the verification process begins upon submission of the orderfor the order begins online on your website and is not yet integrated to the ERP. The order has the status 'pending' on your website . only. Integration to the ERP occurs only after successful verification.

ON: the system will integrate the order to the ERP before the verification process is initiated.This The order has the status 'pending' on your website and in your ERP.

The ON option (used with the Short Charge method) provides increased the following efficiencies for your business during the verification process period:

- stock status - ordered items are committed to that order and are marked unavailable in your ERP so they cannot be ordered by other customers, online and offline,

- multiple orders - when a credit card is verified, all remaining pending orders on that credit card are automatically updated and available for further online processing by your team members,CHECK

- cash receipt issue - cash receipts are written at the time of integration and can be reconciled more easily with your customer's credit card payment since they occur on the same day

Role level Attempts Allowed 3 The number of times the user can attempt to enter a correct amount charged to their credit card before the order is cancelled.

Role level Percentage Split (of the order amount) 85 Applies to the Split Charge method only. The system will split the total amount payable into two charge amounts (the first split equalling this value +/- the Credit Card Verification Percentage Variant). A correct One of the two split charge amounts must be entered to verify credit card ownership.

Role level Threshold Order Amount 250.00 The system will put orders over this amount on hold ('pending') until credit card ownership is verified.

Role level Days to Hold Order 45 The the number of days an order remains open for the user to validate the credit card.

Role level Usage Type Customer Credit Card Verification can be set against the userUser's login or the customerCustomer. Note - Guest user orders (in different application sessions) will trigger verification requests when over the Threshold Order Amount.

Role level Verification Method ShortCharge Select ShortCharge (default) or SplitCharge (note - SplitCharge is a legacy method that is no longer supported by CV.)

Short Charge - the system will charge the credit card once and the charge appears in a single cash receipt. A random amount between the 'Payment Amount' and 'Payment Amount - Max Short Charge Amount' is deducted before charging. The user The actual amount charged must be able to confirm the 'short charge' amount chargedentered to verify credit card ownership.

- The Short Charge method has the advantage of involving a single charge and only one cash receipt, which streamlines the reconciliation of credit card charges with cash receipts for your business and customers, and minimises the number of reversals if they are needed.

- Split Charge (legacy method) - the system will charge the credit card twice in accordance with the 'Percentage Split' previously entered. They appear as two separate charges with two cash receipts. The user must be able to confirm one of the two split charges.

Role level Days Before Initial Reminder Email 2 The number of days after order placement an initial reminder email is sent if the customer has not verified the credit card.

Days Before Subsequent Reminder Email 7 The number of days after the initial reminder email a follow-up reminder email is sent if the customer has still not verified the credit card. Notification Email Blank Enter the email address to which the system will send email notifications of orders pending, awaiting verification.

Online Team Email Blank Enter a team email address to which the system will send email notifications of orders pending, awaiting verification.

Role level Order Integration Order Status 17 This value represents the order status 'pending'. If the 'enable immediate integration' is on, this value represents the order status of 'pending' but unintegrated in the ERP.

Short Charge Settings

Max Short Charge Amount

$1.00

Applies to 'ShortCharge' method only. When ShortCharge Short Charge is selectedin use, the system will charge the order total minus a random amount under the maximum entered here.

...