...

| Multiexcerpt | ||||

|---|---|---|---|---|

| ||||

The Customer Self Service eCommerce Platform currently supports Zip, Openpay, Afterpay, Payright and PayPal Pay in 4 so . Easy for your BPD website can to offer one or more of these Buy Now, Pay Later options to your customers. |

...

While they all operate on a similar principle, there are will be some differences between among the three options.

...

Customers:

- Small establishment fee based on credit limit, which zipMoney will confirm at time of application and contract.

- $4.95 monthly account fee while there is an outstanding balance.

- Limit of $1,000 - $20,000 (subject to credit check and depending on what is offered by the merchant).

...

- Merchants pay a flat % fee per transaction.

- No setup fees, no monthly charges.

- Merchant service fee varies depending on trading volume and the length of the interest-free period .offered (for example, offering 6 months interest-free costs you less than offering 12 months).

- Minimum annual turnover of $500,000.

- Minimum trading history of 12 months.

...

Customers:

- Monthly account fee of $5 accrues if there is money owing at the start of the month.

- Limit of either $250, $500, or $1,000 per customer (determined by zipPay).

...

- Merchants pay a flat (%) fee per transaction.

- No setup fees, no monthly charges.

- Merchant service fee varies depending on trading volume (contact zipPay for further details).

- No lock-in contracts.

Afterpay

...

Customers:

- No fees are charged to shoppers, aside from late fees for missed repayments.

- No set credit limit. The amount a customer can spend is increased over time by Afterpay, once successful repayments have been demonstrated.

Merchants:

- Merchants pay a 4-6% fee per transaction.

- The percentage is set by Afterpay and is based on order volume and value. The more you sell through Afterpay, at increased value, the lower your % fee will be.

...

Customers:

- No interest is charged to customers, but depending on the plan they select, a small management fee may apply to each repayment.

- In the case of high value purchases, an establishment fee may apply to the initial payment.

Merchants:

- Get paid in full (less fees) the next business day, minimising risk to your business.

- Merchants pay a fee per transaction. Contact Openpay for further details)

- Take advantage of access to analytics through the Openpay dashboard, providing insight into order data and customer behaviour.

...

options. Consult with the Buy Now Pay Later providers for more information.

NOTE - PayPal Pay in 4 is available for your site with Braintree Payments.

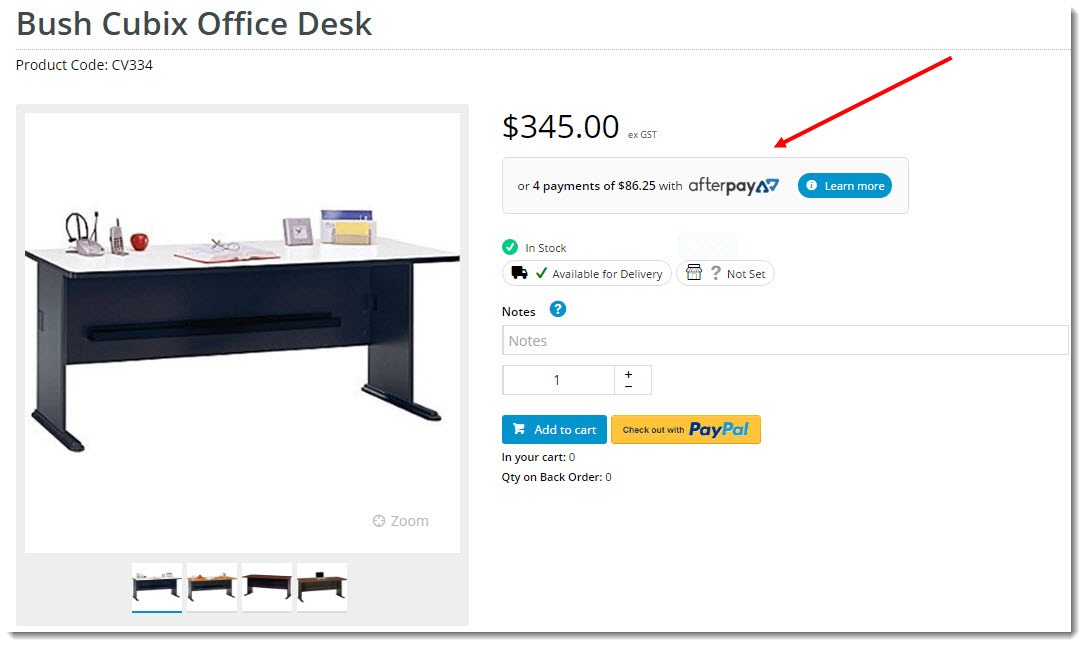

What it looks like

Depending on your site's configurations, potential buyers on your site will see the cost of the product, but also be presented with a Buy Now, Pay Later option with information about instalments and a link to learn more in the Product Detail page, Cart page and as payment during checkout.

Additional Information

...

| MultiExcerptName | Additional Info |

|---|

Set-up Guides

- Zip (version 3.99+, 4.23)

- Afterpay (version 4.08+)

- Openpay (version 4.04+)

- Payright (version 4.24+

- Pay in 4(version 4.31+)

| Multiexcerpt | ||||

|---|---|---|---|---|

| ||||

-- |

| Multiexcerpt | ||||

|---|---|---|---|---|

| ||||

...