...

| Who | How it works | Fees and limits |

|---|

| zipMoney | - zipMoney is a line of credit for larger purchases, generally valuing $1,000 or more.

- Customers enjoy a guaranteed 3 months interest-free period for all purchases, but the interest-free period may be extended up to 36 months by some retailers. (The interest-free period can vary by merchant and is confirmed with the user at the time of their purchase.)

- zipMoney repayments start from as little as $40/month, but are dependant on the credit limit. Repayments can be made monthly, fortnightly, or weekly. Customers can also made additional repayments at any time.

| Customers: - Small establishment fee based on credit limit, which zipMoney will confirm at time of application and contract.

- $4.95 monthly account fee while there is an outstanding balance.

- Limit of $1,000 - $20,000 (subject to credit check and depending on what is offered by the merchant).

Merchants:

- Merchants pay a flat % fee per transaction.

- No setup fees, no monthly charges.

- Merchant service fee varies depending on trading volume and the length of the interest-free period .offered (for example, offering 6 months interest-free costs you less than offering 12 months).

- Minimum annual turnover of $500,000.

- Minimum trading history of 12 months.

|

|---|

| zipPay | - zipPay is an online shopping wallet of up to $1,000, always interest-free.

- First 60 days incur no fees.

- zipPay repayments start from as little as $40/month, and be made monthly, fortnightly, or weekly. Customers can also made additional repayments at any time.

- Funds are available for the customer to use across one transaction or many.

| Customers: - Monthly account fee of $5 accrues if there is money owing at the start of the month.

- Limit of either $250, $500, or $1,000 per customer (determined by zipPay).

Merchants:

- Merchants pay a flat (%) fee per transaction.

- No setup fees, no monthly charges.

- Merchant service fee varies depending on trading volume (contact zipPay for further details).

- No lock-in contracts.

|

|---|

Afterpay | - Afterpay offers fee-free, interest-free credit for purchases

- Instant approval

- Repayments are made over 4 equal, fortnightly installments

| Customers: - No fees are charged to shoppers, aside from late fees for missed repayments.

- No set credit limit. The amount a customer can spend is increased over time by Afterpay, once successful repayments have been demonstrated.

Merchants: - Merchants pay a 4-6% fee per transaction.

- The percentage is set by Afterpay and is based on order volume and value. The more you sell through Afterpay, at increased value, the lower your % fee will be.

|

|---|

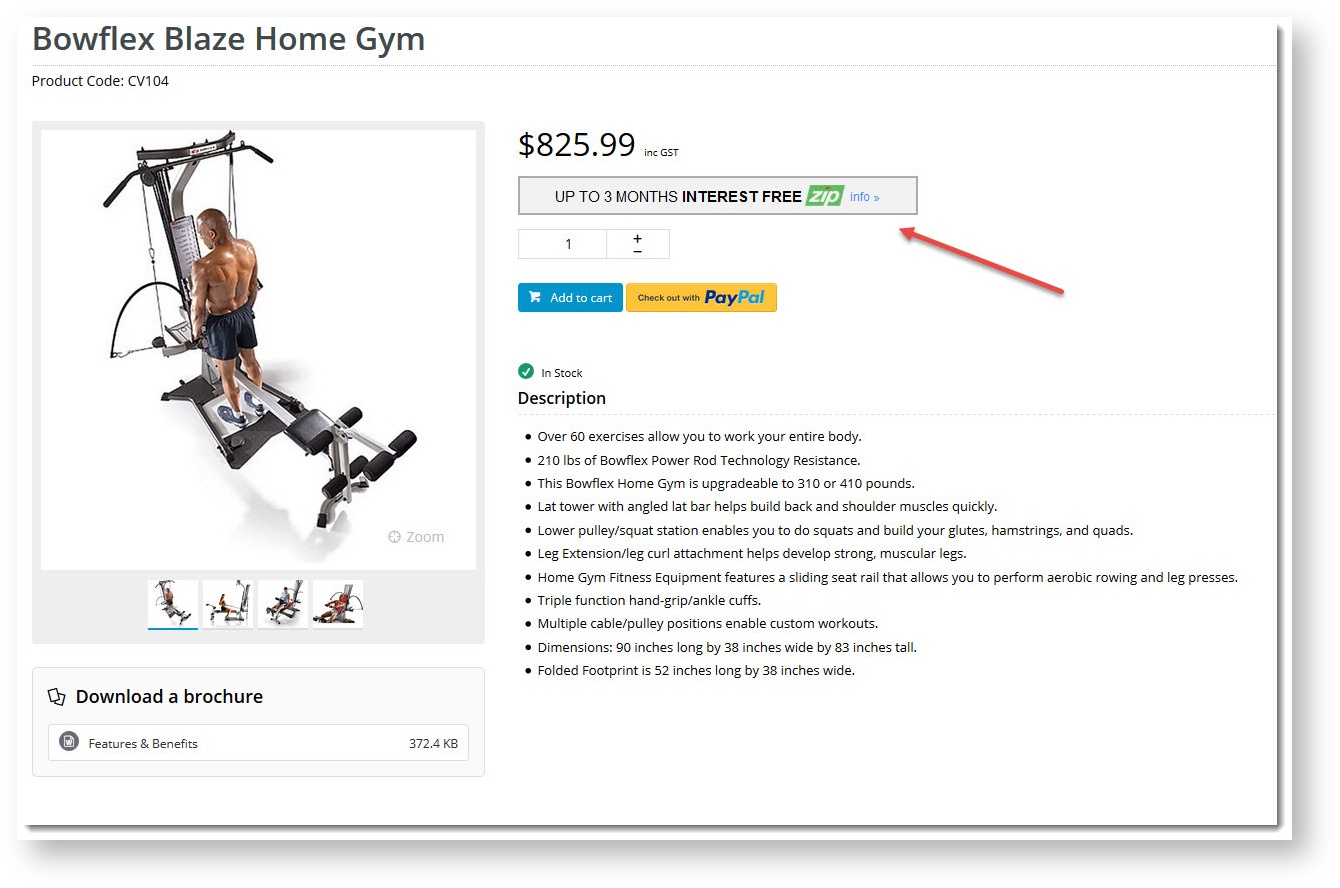

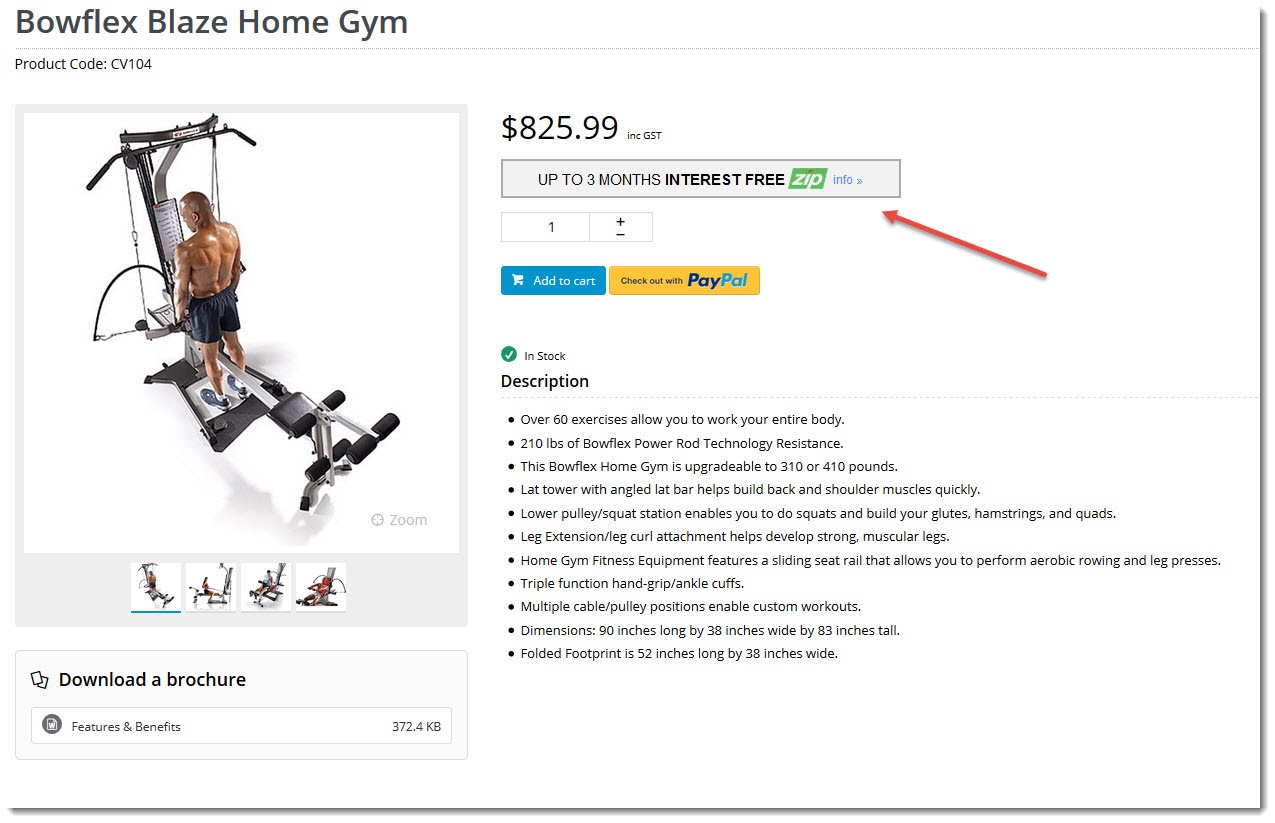

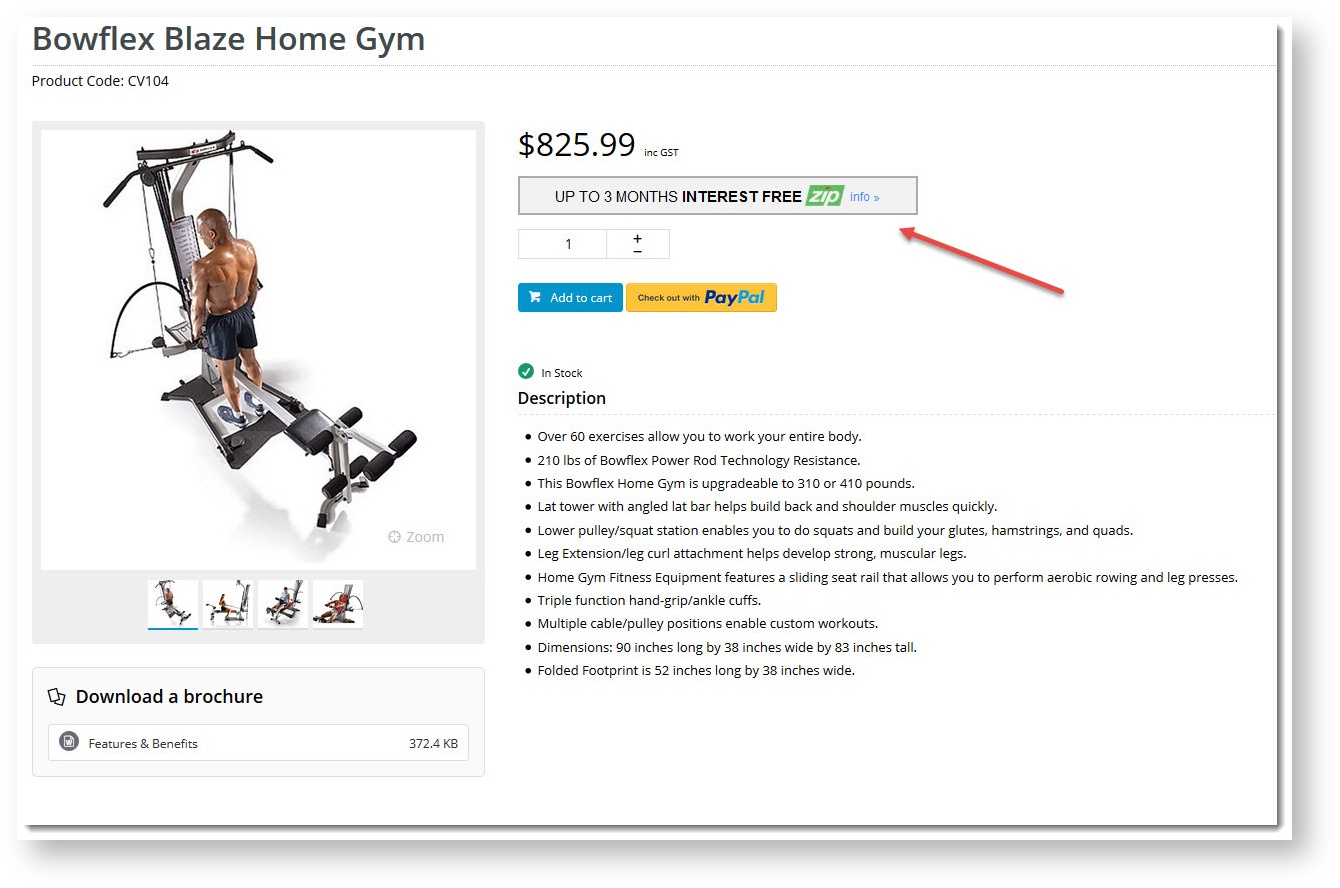

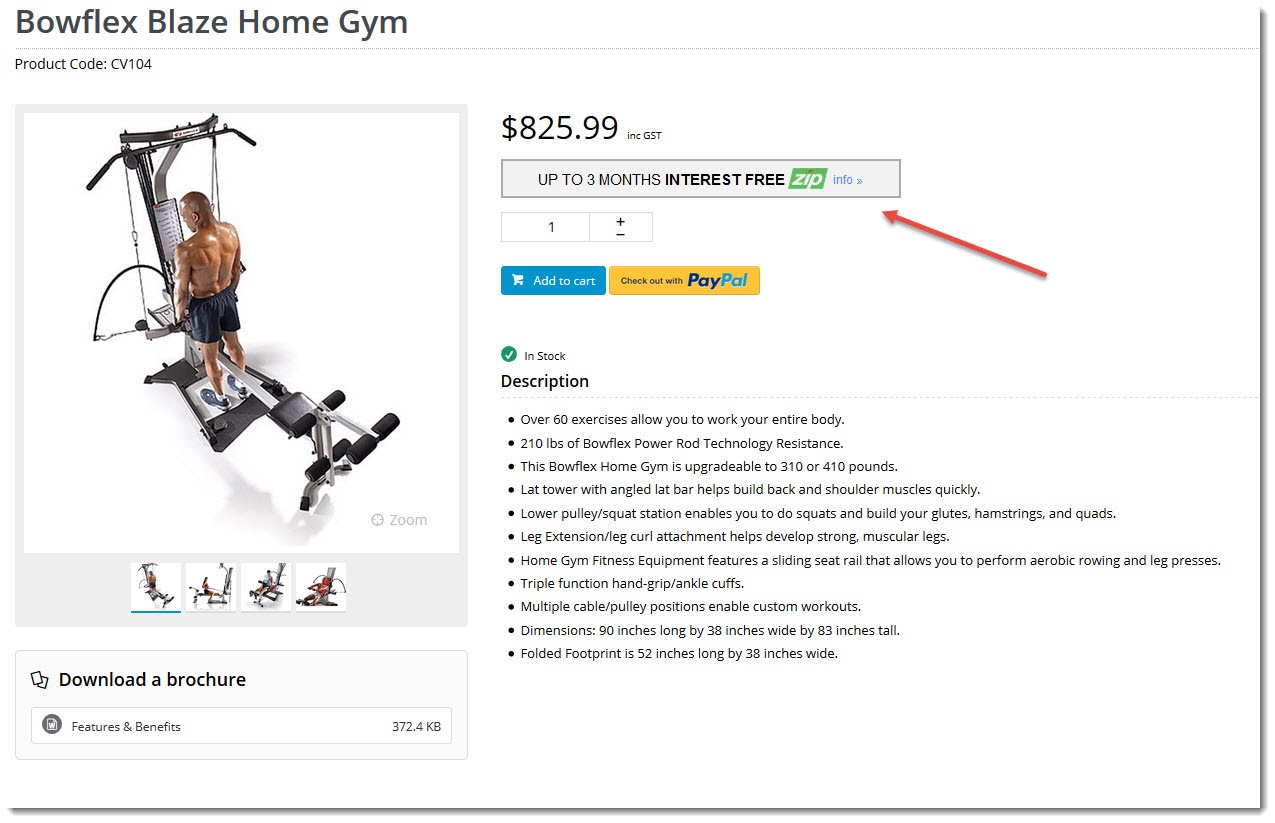

What it looks like

Image Removed

Image Removed Image Added

Image Added

Enable the feature

...

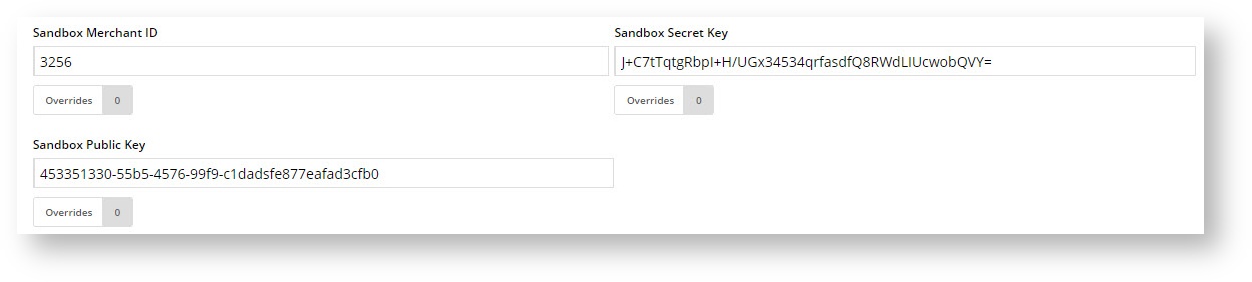

Once the feature is enabled, you can configure the settings.

You'll need an account with your chosen payment provider, so be sure to have your account information handy , - specifically your Merchant IDs, public and secret keys.

- In the CMS, navigate to Settings → Feature Management.

- Configure the Buy Now, Pay Later feature.

- For Zip, use the dropdown menu to select either zipPay or zipMoney. This will ensure you configure the correct settings for your chosen option.

For Afterpay, leave the dropdown at 'Disabled' until you've configured all the settings.

- Scroll to the provider section you wish to configure (Zip or Afterpay) and select the Mode:

- Disabled - not in use

- Sandbox - for testing on your stage site

- Production - for the live site

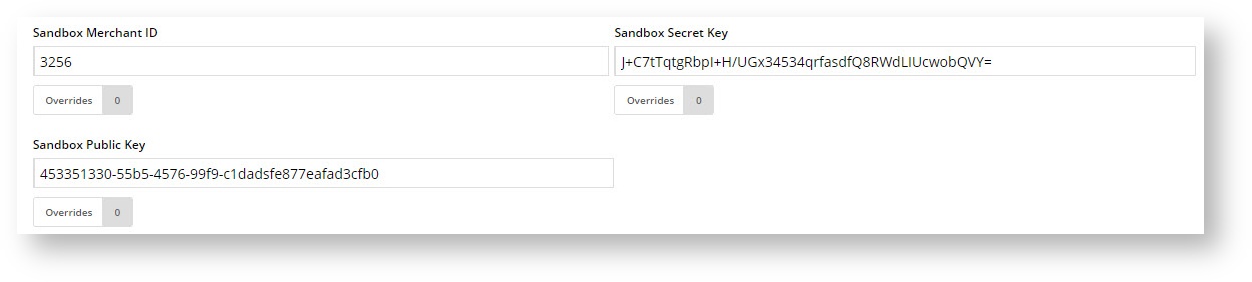

- Enter your Merchant IDs and Keys in the relevant fields (Production / Sandbox).

- Zip Merchant Unique ID = Public Key

- Zip API Key V1 = Secret Key

- Set the following options:

- Event Logging - toggle this ON (recommended)

- Auto-Integrate Pending Orders (zipMoney & Afterpay only) - integrates orders to the ERP prior to receiving a response from the payment provider.

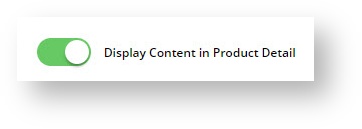

- Display Content in Product Detail - toggle on to show the relevant provider's logo & info on the product detail page, which launches a pop-up explaining the payment option.

- If you're configuring Afterpay, that's it! Click Change the Afterpay dropdown to 'Enabled', then Save & Exit.

- If you're configuring zipMoney / zipPay, continue to next step.

- Disable Further Checkout Attempts with Provider for an Order if Declined - toggle on / off as required.

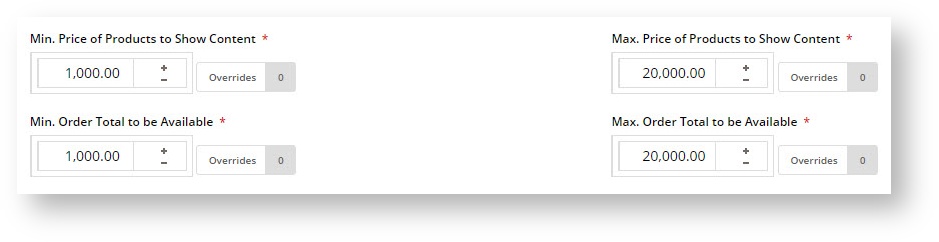

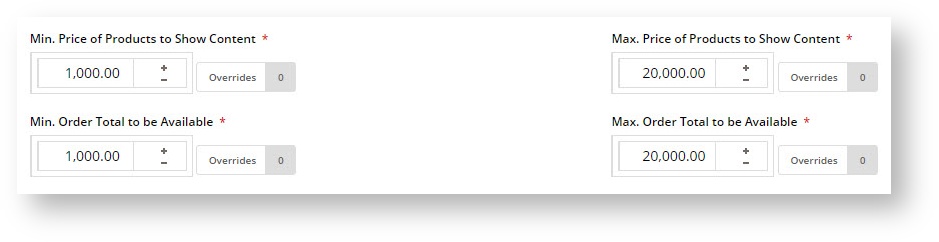

- Set Product / Order value limits:

- Min Price of Products to Show Content - product price must meet this value before zip info box displays on the page.

- Max Price of Products to Show Content - product price must fall below this value for zip info box to display on the page.

- Min Order Total to be Available - order total must meet this minimum value in order for zip option to be offered at checkout.

- Max Order Total to be Avaialble - order total must fall below this value in order for zip option to be offered at checkout.

- Save / Save and Exit.

About Overrides

...

For example, you may wish to display the zipPay Afterpay info box on the Product Detail page for B2C users, but not for B2B. In this case, you could set an override.

...