...

- In Braintree Payment Settings, scroll down to the Fraud Protection Settings for Order Payment section.

- In Fraud Protection Mode, select Basic, Advanced or Kount. NOTE - The mode enabled her must be the same as the mode enabled in your Braintree account.

Basic - all fraud protection is handled by Braintree and no further configuration is required here.- (For 'Advanced' or 'Knout' only.) In Treat Decision 'Not Evaluated' As, select 'Review' or 'Approve'.

Review: the transaction with this status is treated as suspicious and put on hold subject to further verification

Approve: the transaction with this status is treated as a successful one and the order is released.- (For 'Knout' only.) In Treat Decision 'Escalate' As, select 'Review' or 'Approve'.

Review: the transaction with this status is treated as suspicious and put on hold subject to further verification

Approve: the transaction with this status is treated as a successful one and the order is releasedTo use 3D Secure, toggle ON Enable 3D Secure. NOTE - This feature adds another layer of security for payments that use credit cards, including Google Pay. It is applicable only to cardholders who have enrolled in 3D Secure with their issuer.

Expand

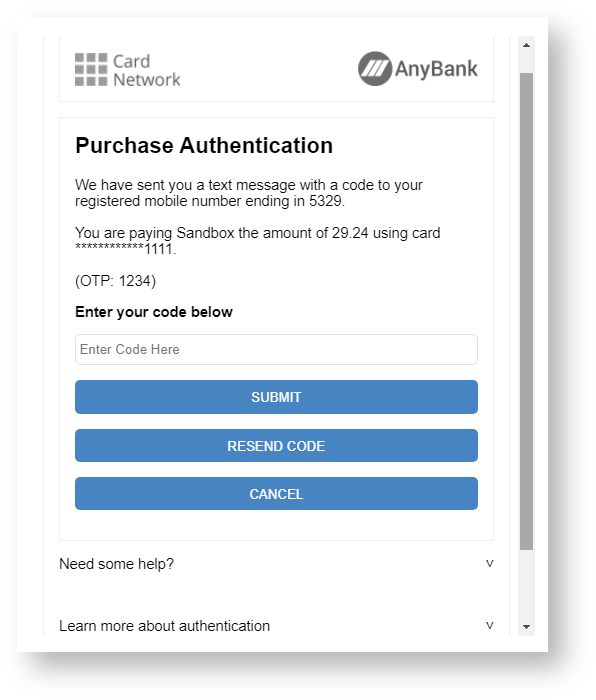

title Click here to know more about 3D Secure... During the checkout process, if the cardholder is enrolled in 3D Secure, the issuing bank will decide whether the cardholder's identity can be verified using data supplied regarding the cardholder and their device, or if an additional authentication process is necessary. If additional authentication is necessary, Braintree will begin a process provided by the issuing bank to verify the cardholder’s identity via SMS one-time passcode, the issuing bank's mobile app, biometric methods, or other means.

3D Secure can shift liability for fraud-related chargebacks from the merchant to the card issuer. For example, if the issuer does not participate in 3D Secure but the card brand supports this extra protection (i.e. Visa or Mastercard), the liability for fraud-related chargebacks will shift to the issuer.

NOTE - 3D Secure does not shift liability for all fraudulent chargebacks. You can determine whether or not liability shift occurred by the 3D Secure status code returned for the authentication.

Example of 3D Secure popup:

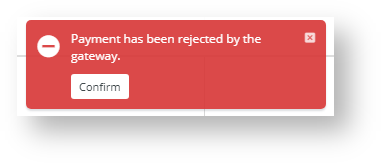

If the credit card payment passes 3D Secure, the order will be completed. If the payment is 3D-rejected, the User will see a 'Rejected by Gateway' popup error message on your site:

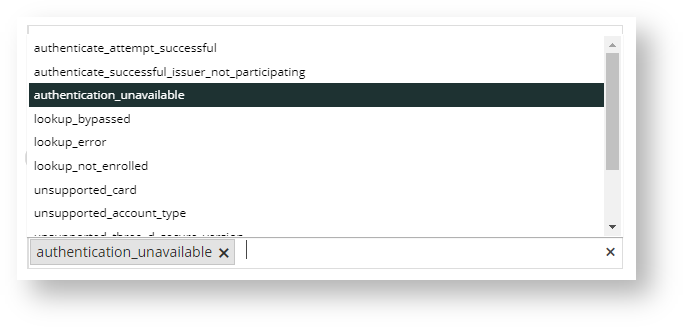

This status is also recorded in the Braintree account.- (For use with 3D Secure only). The 3D Secure Review Status List provides all 3D Secure statuses that will not reject the order if 3D is not required. it allows you to put such orders on hold for further verification. For instance, 'authenticate_attempt_successful' means that the card brand passed the attempt because the issuer's authentication server was unavailable. You can add one or more such statuses. NOTE - For a list of what each of the statuses mean, refer to the Braintree website.

Click on the list, then click to select all required statuses. These statuses will populate the field.

...