Background

The nature of ecommerce is that online payment transactions can be put through 24 hours a day, 7 days a week. This makes reconciliation of credit card payments more difficult due to different cut-off times for transfer of payments in to the supplier's account. For example, online payment transactions processed after 5PM on a given day may be accounted for by the bank on the following day. The effect of this issue is a variance between total orders value for a day compared to payments deposited into a supplier's account.

If you are with Direct Payment Solutions (DPS) (also known as Payment Express), you can read more about the reconciliation process here - http://www.paymentexpress.com/Knowledge_Base/Frequently_Asked_Questions/Merchant_FAQs#Reconciliation.

Reconciling Credit Card Transactions

Credit card transactions in PRONTO are posted to a clearing account. Using a CSSBANK account to record all deposits from online payment systems allows you to create a journal entry to transfer funds from the CSSBANK account to the main account, after reconciling the payments.

PRONTO Set-up

- Create a General Ledger Account that will be used for Online Payment Clearing for payments received from the website. This should be a separate account to any current cash deposit accounts. This is an asset account and should be set up near the current 'Cash at Bank' or similar account.

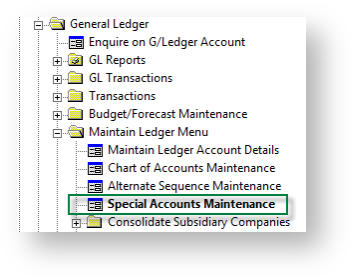

- Navigate to 'General Ledger' --> 'Maintain Ledger Menu' --> 'Special Accounts Maintenance'.

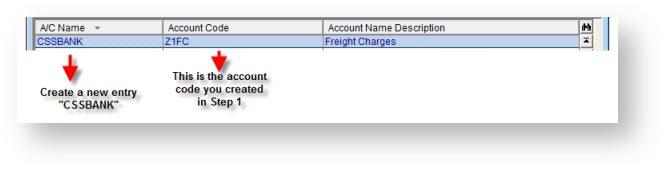

- Click 'Entry' to create a new account.

- Enter "CSSBANK" into the 'A/C Name' field (one word, no quotation marks).

- Enter the GL Account code from Step 1 into the 'Account Code' field.

- Enter an 'Account Name Description' (e.g. 'Web Visa & Mastercard').

- Hit 'Esc' to save the entry.

How it works

- Payment is processed on CSS via the payment gateway.

- The Integrator uploads the order and payment information into PRONTO.

- A journal entry is created (same as normal sales order).

i.e.:

DRCSSBANK

CRDebtors (against the account on the order)

- At the end of the day, an amount is transferred to your account from the bank. This will be the total amount of all transactions up to a certain time (i.e. close of business for the bank).

- As part of the end of day process, the amount you received into your bank should be removed from the CSSBANK account; the remaining balance will be any transaction that was processed after the end of day post.

We recommend that you use the batch number (provided by the payment gateway with each deposit) as your journal entry reference number.

i.e.:

DRNormal Cash Account $Amount Deposited to Bank Account

CRCSSBANK $Amount Deposited to Bank Account

- You may also download individual transactions detail from your payment service provider (if service is available), which would match up to each entry in the CSSBANK account.

The above process should be used as a guide only; please consult your accountant or business manager to develop your own internal reconciliation procedure for online transactions.

Splitting based on Transaction Type

Transactions for CSSBANK can be split out for Amex, PayPal and EFT payments using the following accounts:

- CSSBANKAX (for Amex)

- CSSBANKEFT (for EFT)

- CSSBANKPP (for PayPal) - CSS Version 3.70+ required for PayPal split

- CSSBANKBP (for BPAY) - CSS Version 3.70+ required for BPAY split

- CSSGC (for Online Gift Cards)

To create any of these accounts, simply follow the PRONTO Set-up instructions outlined above, replacing "CSSBANK" with the appropriate variant listed here.

Related articles